Market Commentary: November 2023

November saw a large reduction in bond yields as the market took a better-than-expected US inflation print to conclude that the US Federal Reserve has beaten inflation, are done with further rate hikes and that a pivot (cash rate cuts) are on the cards for early 2024. The result of this change in belief saw a rally in growth assets, in particular bond proxies such as listed real estate and infrastructure, and the US Dollar weakened.

US inflation year on year to October slowed from 3.3% to 3.2% which triggered a rally in bond yields and equities- this was the total opposite of what happened in October when US GDP was strong, and the market reacted by pricing in a higher for longer cash rate outlook with yields rising and equities selling off. The best example of this market volatility over the last two months can be seen in Australian listed real estate trusts (AREITs) whose prices were down 5.8% in

October but rallied 11.0% in November.

Australian inflation fell in October to an annual pace of 4.9%. It was the first time in almost two years that inflation has fallen below 5%, and much softer than the figure of 5.6% for the year to September. With a cash rate at 4.35% and inflation running at an annualized rate 4.9% monetary policy would appear accommodative. However, the rate of change indicates inflation may be peaking and therefore the RBA can be less hawkish on their cash rate outlook.

Australian large cap Equities rose by 4.8% with Healthcare the standout returning 11.7% and the Energy sector the weakest falling 7.4% as the oil price fell in the month. Hedged global equities rose by 8.0% whilst unhedged global equities rose by 4.4%, as the Australian dollar strengthened by 4% over the month to US$0.6605.

The Australian 10-year government bond yield decreased by 51bps to 4.41% and the 2-year government bond yield decreased by 35bps to 4.11%. The US 10-year government bond yield fell by 60bps to close at 4.33% and the US 2-year government bond yield decreased by 41bps to 4.68%.

Key Developments Post Month-End

The RBA met on 5th December and decided to keep the cash rate at 4.35% The RBA noted that: “Whether further tightening of monetary policy is required to ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks. In making its decisions, the Board will continue to pay close attention to developments in the global economy, trends in domestic demand, and the outlook for inflation and the labour market”.

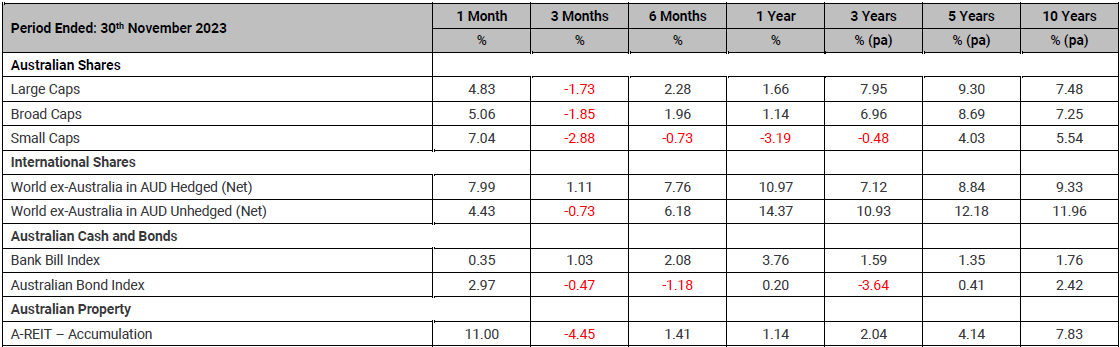

Benchmark Returns

IMPORTANT INFORMATION

THIS IS A PUBLICATION OF PERSONAL FINANCIAL SERVICES LIMITED ABN 26 098 725 145 (AUPFS). ANY ADVICE IN THIS ARTICLE IS GENERAL ADVICE ONLY AND DOES NOT TAKE INTO ACCOUNT THE OBJECTIVES, FINANCIAL SITUATION OR NEEDS OF ANY PARTICULAR PERSON. IT DOES NOT REPRESENT LEGAL, TAX OR PERSONAL ADVICE AND SHOULD NOT BE RELIED ON AS SUCH. YOU SHOULD OBTAIN FINANCIAL ADVICE RELEVANT TO YOUR CIRCUMSTANCES BEFORE MAKING PRODUCT DECISIONS. WHERE APPROPRIATE, SEEK PROFESSIONAL ADVICE FROM A FINANCIAL ADVISER. WHERE A PARTICULAR FINANCIAL PRODUCT IS MENTIONED, YOU SHOULD CONSIDER THE PRODUCT DISCLOSURE STATEMENT BEFORE MAKING ANY DECISIONS IN RELATION TO THE PRODUCT AND WE MAKE NO GUARANTEES REGARDING FUTURE PERFORMANCE OR IN RELATION TO ANY PARTICULAR OUTCOME. WHILST EVERY CARE HAS BEEN TAKEN IN THE PREPARATION OF THIS INFORMATION, IT MAY NOT REMAIN CURRENT AFTER THE DATE OF PUBLICATION ANDAUSTRALIAN UNITY PERSONAL FINANCIAL SERVICES LTD (AUPFS) AND ITS RELATED BODIES CORPORATE MAKE NO REPRESENTATION AS TO ITS ACCURACY OR COMPLETENESS.